Do I need an accountant to prepare accounts?

Do I need an accountant to prepare accounts? Or,

Do I need an accountant to file company accounts? Or,

Do I need an accountant to sign off business accounts? Or,

Do I still need an accountant if I use Quickbooks? Xero? Clearbooks? Sage? Or any accounting software?

The approach to using an accountant or a professional for your accounts and tax returns should be the same as hiring any professional where getting things wrong have consequences. Sometimes things look simple and you are willing to take a risk but still you rather make choices that other people in your circumstances are making too, to reduce the risks.

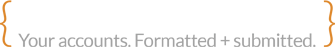

For example, how many people will use an electrician depends on the issues ?

When changing a bulb most people will not call for an electrician but for most electrical issues you would need a professional electrician to do the job.

Likewise, when it comes to finalising the accounts, formatting reports and filing we see people doing it themselves mainly in two scenarios:

A) it’s a one or two people small business and activities are not many or complex. They are able to calculate their Income and profits almost accurately and are confident because of past knowledge and experience.

B) The business small but not micro. It is big enough to have in-house accountant or bookkeeper.

In both cases, Accounts Template provides a cheaper alternative then engaging Chartered Accountants. Since these businesses are not seeking tax advise, they just require a professional to help with formatting the accounts reports with appropriate accounting standards and deal with the process of submissions to Companies House and HMRC ensuring filing is done successfully.

According to Companies House guide ‘The directors of every company must prepare accounts for each financial year’.

There is no requirement for companies to use a professional accountant to prepare their accounts. However, directors should be aware of their legal responsibilities regarding accounts and if they are uncertain about the requirements, they may consider seeking professional advice.

Contents of your company’s accounts

Generally, accounts must include:

- a profit and loss account (or income and expenditure account if the company is not trading for profit)

- a balance sheet signed by a director on behalf of the board and the printed name of that director

- notes to the accounts

- group accounts (if appropriate)

And accounts must generally be accompanied by;

- a directors’ report signed by a secretary or director and their printed name, including a business review (or strategic report) if the company does not qualify as small

- an auditors’ report stating the name of the auditor and signed and dated by him (unless the company is exempt from audit).

Should you then engage an accountant or professional to prepare and submit the Accounts to Companies House and HMRC?

As a good practice you should definitely consider using a professional even when the affairs are simple.

Accounting and tax rules are complex. Unless you are qualified or have experience in the field it is safer to engage a professional to avoid any major issues.